In my (future) posts, I plan to skip over the basics and assume my readers are intelligent enough to pull up basic filings. However, a brief history of the company evolution would help set some context.

Oracle has transformed itself several times since it was founded about 50 years ago (and uniquely so). It started as a relational database business, then began building enterprise applications such as e-business suite. What followed was a period of rapid consolidation - first in applications (e.g. Peoplesoft), then middleware (e.g. BEA, Hyperion, etc.), followed by an aggressive push into vertical specific software. When Oracle acquired Sun during the GFC, it gained several key assets that would later benefit the company: knowledge of how to operate a supply chain (think IaaS a decade later), Java and MySQL. What came next was a string of acquisitions to get the Company into the Cloud business. Let me pause here because my view is that the current phase and next phase will make sense in context of history and Microsoft.

What causes a re-rating?

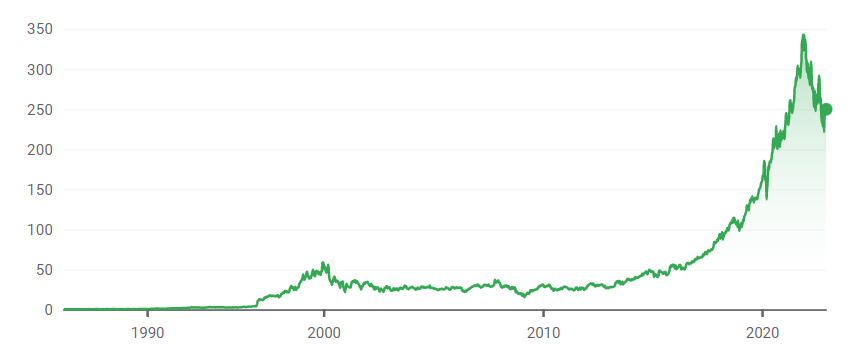

If you followed Microsoft long enough, you’d remember the lost decade when the stock was side-ways and there seemed to be no catalyst to change the course. Outside the core monopoly franchise, the company seemed confused about what MSFT should become - gaming, phones, ads, Yahoo, the list goes on. When Satya took over in 2014, several things happened: (1) There was focus, (2) Acquisition program was put on hold for the most part, bolting gems onto a rusted ring isn’t going to create value and (3) rationalization of things that no longer fit the the focus (e.g. dumping Nokia).

With the gift of hindsight and some help from sellside analyst models that attempts to estimate different parts of Microsoft, I pegged the mix of businesses within Microsoft circa 2015 to be ~20% growers, ~50% flat and stable and 30% legacy. Once the business foundation was laid out, you have seen Microsoft become very aggressive in M&A to accelerate the efforts (Git, Linkedin, etc.). Fast forward to today, that mix is now probably 60%+ in the growing category and <10% in legacy negative growth. Because subscription revenue is like a bucket, as long as you fill in more than it leaks out, the revenue begins to accelerate. Once the mix becomes larger and larger, revenue begins to accelerate mathematically. At this point it doesn’t take a genius to understand why its P/E doubled from the mid-teens as earning power becomes materially more durable. A lot of EPS x double the P/E = significant equity value appreciation.

Where is the parallel?

Let me first highly simplify the business of Oracle as I see it. From the outside, the striking different between today and 4-7 years ago is focus. Back then, there was a kid in the candy store feel where there wasnt a market or business they didnt like; As a result, Oracle made many acquisitions in SaaS that I would presume have underperformed. Fast forward to today, if you follow the corporate messaging on earnings, IR meetings, ORCL is focused on a few specific areas: (1) Win back-office cloud (financial, HR, supply chain), (2) We are the new modern entrant in IaaS with Gen2 OCI unencumbered by legacy infra AWS built decades ago and (3) Using their vertical portfolio and expertise to differentiate the offerings holistically. Acquisitions have been made to accelerate specific IP portfolios and appear to be much more aligned to the goals.

If I had to guess what the portfolio looks like on a quadrant, i’d imagine it looks something like this:

Where Oracle is strong: Database, ERP (including Netsuite), HRIS, vertical specific applications

Where Oracle is weak: The full range of CX from marketing, service, commerce, sales automation

Where Oracle is nascent today, but with potential for significant growth: OCI. Their latest investor presentation provides context for how far Gen2 has come in just 5 years. 5 services to over 100, 1 region to almost 50, running exclusively bare metal to now a highly distributed set of workloads with noticeable market traction in AI/ML. With now 18K customers, including one of the most demanding workload in history (TikTok), checks are indicating significantly more organic notice from customers. As IaaS core solidifies, I bet you can expect them to begin focusing on the PaaS layer where they still command a significant customer base.

The most notable parallels disclosed in the IR material is that the Cloud revenue (which one can reasonable equate to growth portfolio) is now up to 30% of mix with growth accelerating to 30% organically. Which means Oracle has already surpassed the transition point of where Microsoft was circa 2015.

Bottom line.

(im going to use round simple numbers here, as I believe false precision is an enemy to investors)

To quantify the risk and reward standing where we are ~$80/share:

Today, the company trades at ~16x PE and the latest IR presentation guided to at least 10% CAGR on EPS for the next 3 years which roughly takes you to $6.66.

Range of outcomes: Keep in mind these would be substantial upside to these ranges depending on capital allocation decisions. There is a large mountain of debt on the balance sheet post-Cerner which I would argue can be de-levered materially through cash generation. Of course, should they instead to pursue another large acquisition, the risk equation shifts.

With industrials now trading at mid-20x PE on near-zero topline growth and structurally challenged margin structure, I believe it is highly conceivable that a company on the cusp of mathematical acceleration can be re-rated to 20x with a bullcase for higher. The more interesting part of the equation is given the strong cost management culture at the company, the downside does not imply tremendous risk relative to the upside potential for a double. From a risk/reward perspective, I continue to see Oracle as one of the most interesting equity stories in the market today.

For a company as levered as ORCL is, you're assuming one of the highest EV / FCF multiples it has ever traded at (outside of their massive share repurchases that the company executed during 2021 to make sure that Larry and Safra hit their $200MM+ performance grants, which vested at $80 / sh.), when they are the 3rd/4th best infrastructure provider, and their largest area of growth (OCI), is dilutive to margins (estimated to be ~30% gross margins). While I do agree that the downside should be relatively limited here, given their large, recurring, stable core revenue base, I think the upside is relatively limited at $80 per share.

As I think about this stock, and the timing of their medium-term guidance, I can't help but wonder why a company would provide 4-year forward looking guidance, when this is not something that they have done historically... do we think it may be to try and keep investor interest in their story as EPS and FCF diverge and they do not have as much financial flexibility to support their stock in the open market?

I like your writing. Would you be interesting in contributing to a bigger newsletter with thousands of readers already, for a fee? Email me, michael@tendies.af