Lets face it, public software universe is an extension of industrials at this point. As a coverage universe, we are faced with several factors at once:

excess competition from decades worth of crowding

pullforward in many sectors that never saw sustained demand

general budget shift towards AI infra projects

consumption trends impacted by infrastructure right sizing

debate that AI will render traditional workflow obsolete

When I look at my core universe of 170 companies between horizontal, vertical and a few select HCIT companies representing $550B aggregate revenue, the current expectation is for ~11% growth in 2025 and 10% growth in 2026. Thats not too exciting when the investor base has grown accustomed to 20, 30, 40% growth.

However, I see two opportunities being presented:

First, lets frame the software as industrials discussion. The profile of an average industrial company today is as follows:

2-5% topline growth

15%-20% operating margins

~20x EBIT multiple / 23x PE

Some level of capital return commitment

In contrast, large cap SaaS is actually trading at a discount. For example:

Adobe: 9% topline, 46% margin, 16x EBIT, 20x PE

Salesforce: 9% topline, 34% margin, 18x EBIT, 24x PE

Opportunity #1: Lets assume software is dead and we are looking at GDP+ levels of growth. I would argue that over a longer time horizon, large stick software businesses should eventually converge to a premium over industrials. These businesses remain capital light, have tremendous operating leverage with built-in pricing escalators in contracts with optionality for better capital return programs. AI today has been largely limited to marketing and very basic capabilities such as summarization. Despite all the splash, I would urge you to read through a copy of any LLM’s zero data retention policy (ZDR) which stipulates the use cases that automatically defaults to no human review. You’ll be find any sophisticated use cases or vertical use cases will not fall into this category. I think AI plays out in one of two ways for the broader software ecosystem:

AI becomes a native feature. It can be part of the base product in which case the differentiation manifests in higher win rate or an add-on SKU. In either case, the value to the end customer must catch up quickly

AI is bullshit. In this case, we are back to baseline 2026 expectations and we are severely overinvested in AI infrastructure if we cannot get B2B use cases into production

When AI native workflow businesses get built (think a new CRM or GL that im sure some wiz kids are dreaming out right now designed with AI at the foundation architecture), the disruption will happen at the SMB level first, and will take a very long time to touch large enterprises

In either case, i would argue that $100 in CRM, WDAY, ADSK and ADBE is a good bet.

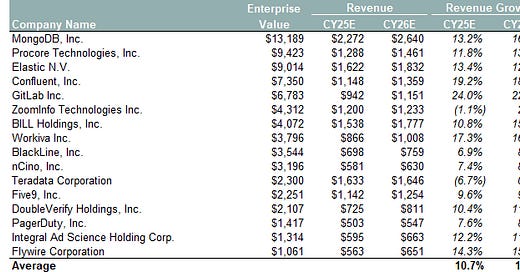

Opportunity #2: "Basket of Cheaper Optionality.” I’ve curated a SW basket which I believe have at least one of the following optionality:

Opportunity for significant margin right sizing should growth not materialize which then sets a new valuation floor

Priced in structural disruption that may not materialize (e.g. Flywire, Bill.com)

Take-out optionality

or simple, consumption growth actually returns to a higher level

My key criteria here is each company must have some intrinsic optionality which rules out a big chunk of companies (sorry ZM, DOCU, i just dont see it). When you factor in some margin uplift, the valuation as a basket quickly becomes “industrial like” with more potential.

Here is my curated list